|

| https://en.wikipedia.org/wiki/Debt-to-GDP_ratio#Changes |

CNN, 9 January 2024, has Trump saying "I don’t want to be Herbert Hoover." CNN adds: "The US

stock market crashed during former President Herbert Hoover’s first year in office in 1929, which

signaled the beginning of the Great Depression." See my work on the Trump Depression

Subscribe to:

Post Comments (Atom)

-

I've been hearing the phrase "late capitalism" for so long that I'm forced to conclude that the very concept of late cap...

-

It is surely true that the price level cannot rise without a corresponding increase in the quantity of money or velocity or use of credit. ...

-

Went to Harbor Freight the other day. When I left, there was so much traffic I had to fight my way out of the parking lot -- at one p.m. on ...

-

As I write this it is mid-October in an even-numbered year. Elections are weeks away. Yesterday, I saw Republican candidates heavily adver...

-

I'm not a fan of "diagrams" in economics, but sometimes... This is a screen capture of slide 36 from a SlideShare presentatio...

2 comments:

From Dean Baker, back in 2013:

"... if GDP grows quickly then the debt to GDP ratio is likely to fall. (Since GDP is the denominator in the ratio, a faster growing GDP directly lowers the ratio.)"

Baker is unquestionably correct: If the denominator increases, the value of the ratio falls. (If the number of people sharing a pie increases, the size of the average slice gets smaller.)

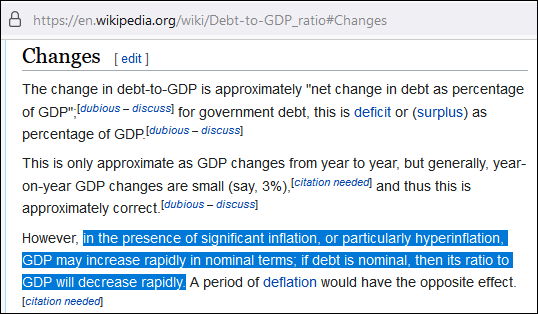

Note, however, that the debt-to-GDP ratio is a ratio of nominal values. The ratio gets smaller when GDP increases EVEN IF THE INCREASE IS ALL INFLATION AND NO REAL GROWTH. I'm NOT recommending inflation. I'm just pointing out the fact.

I'm pointing it out because the statement "the debt-to-GDP ratio was low before the 1980s because of the Great Inflation" is the most-denied true fact in all of economics.

What'll it take for you to be convinced?

From Patrizio Lainà, back in 2011:

"If high inflation would prevail during high level of debt, the economy would stabilize much faster as it would be relatively easy to repay debt... Ahokas and Kannas (2009) argue that, from this perspective, high inflation rate during the 1970s was actually beneficial in order to recover from the high level of debt that was accumulated in the early 1970s."

This is the first time I've seen the "inflation lowers the debt-to-GDP ratio" idea applied to the Great Inflation.

Post a Comment