Begin with an observation by

Simon Wren-Lewis:

[The] consensus assignment [1] is that interest rates should be used to stabilise the economy rather than fiscal policy. The whole idea of independent central banks setting interest rates is predicated on this assignment.

Use interest rates to stabilize the economy, and fiscal policy for other things: This is the Consensus Assignment. Then, a powerful thought: "The whole idea of independent central banks setting interest rates is predicated on this assignment."

Simon's footnote reads

[1] The term assignment comes from the idea that you have two instruments that can control inflation, fiscal policy or interest rates, and an assignment is where only one instrument is used to do the job. You could use both, of course, but if each instrument is controlled by different people with different views about the economy obvious problems could arise. Also in simple New Keynesian models it is optimal just to use monetary policy. I use the term conventional or consensus because it is the assignment that pretty well all advanced countries use, and the one most mainstream academic macroeconomists would recommend.

Pretty well all advanced countries use interest rates to stabilize the economy, and fiscal policy for other things.

In

an older post Wren-Lewis says

Inflation targeting by central banks involves an attempt to manage the economy in much the same way as Keynesian fiscal activism had done before.

That sentence shines light on a change in the "consensus assignment" and gives me a better feel for what the term means. In that post also, Wren-Lewis describes the consensus assignment as "monetary to demand management, fiscal to debt control".

As Simon puts it, we rely on central banks to "stabilize the economy" or "manage" demand. But

you can't push on a string. So the management is one-sided: It can reduce growth, but it cannot increase growth. (It can allow growth to increase, but cannot force growth to increase.) So you really don't have "management" of demand. All you have is

attenuation:

|

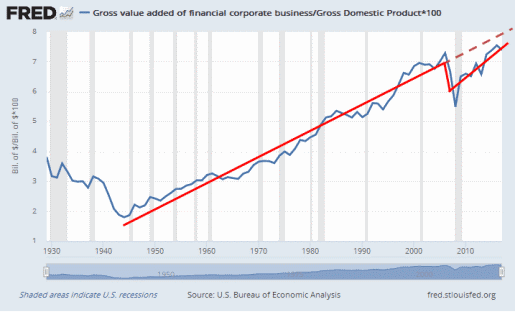

| Attenuation of Demand since the 1980s |

The high points on the graph are generally lower after 1983 than before. That's attenuation.

Also, the lows are generally higher after 1983. This probably means that the growth that was cut off the top came back later to fill in the lows at the bottom. Demand was postponed from a time of high growth to a time of low growth. That's pretty interesting. It could account for the

reduced volatility described by the words "the great moderation".

That seems right.

Average growth during the Great Moderation was a little lower than in the years before. You would expect average growth to be a little lower, if your method of management is to postpone growth.

I would say that the higher lows since the 1980s were not so much policy as the economy's response when "demand management" relented in its battle against inflation. As the 2009 recession shows, however, attenuating the highs does not give you control over the lows. You can allow growth to increase, but you cannot force it. You can't push on a string.

By the way, Wren-Lewis is not defending the "monetary to demand management, fiscal to debt control" consensus assignment.

He says it's dead. If so, we probably need a new match-up of policy instruments and economic objectives.

In his "

Consensus Assignment is dead" post, Wren-Lewis quotes Martin Sandbu:

Besides, there was broadly shared understanding among macroeconomists and central bankers of the best division of labour. Fiscal and budgetary policy should be set to achieve microeconomic and distributive goals, and the desired share of the state in the economy; while monetary policy should take care of stabilising aggregate demand.

Division of labor. Wren-Lewis replies:

This is what I call the Consensus Assignment, and as the name implies it was certainly the consensus among mainstream macroeconomists before the 1990s. But the experience of Japan’s lost decade where they also had interest rates stuck at the ELB began a process of rethinking. By the time the GFC came around many macroeconomists had realised that there was an Achilles Heel in the Consensus Assignment. Fiscal stabilisation was still required when interest rates hit their ELB. That is why we had fiscal stimulus in 2009.

Here again we find monetary policy attenuating demand. Fiscal, Sandbu says, is used to manage the shape and the size of the economy. Wren-Lewis reduces this to a single sore point: "fiscal to debt control". I would say "fiscal to economic growth" -- to the shape and size of the economy.

Similarly, I would reduce "monetary to demand management" to "monetary to inflation control".

From

JW Mason:

An increasingly visible school of heterodox macroeconomics, Modern Monetary Theory (MMT), makes the case for functional finance—the view that governments should set their fiscal position at whatever level is consistent with price stability and full employment, regardless of current debt or deficits.

Fiscal to inflation control, monetary to debt control. The opposite of the consensus assignment described by Simon Wren-Lewis. Mason continues:

Functional finance is widely understood, by both supporters and opponents, as a departure from orthodox macroeconomics. We argue that this perception is mistaken: While MMT’s policy proposals are unorthodox, the analysis underlying them is largely orthodox. A central bank able to control domestic interest rates is a sufficient condition to allow a government to freely pursue countercyclical fiscal policy with no danger of a runaway increase in the debt ratio.

Central banks using interest rates for debt control: again, the opposite of the assignment described by Wren-Lewis.

Mason continues:

The difference between MMT and orthodox policy can be thought of as a different assignment of the two instruments of fiscal position and interest rate to the two targets of price stability and debt stability.

Mason describes it as

a different assignment of the two instruments to the two targets. Here he is using Wren-Lewis's "consensus assignment" concept and terminology as a framework to describe the way economic policy is used.

That is fascinating, I think. And useful: It helps me see the assignments as assignments rather than as economic laws. Simon points out that the consensus assignments are widely accepted by policy economists in "pretty well all advanced countries" and by "most mainstream academic macroeconomists". That may make changing the assignments difficult. But it doesn't make them laws.

From me, from a long time ago,

my own view of what the assignments are and the problem with that arrangement:

Government has two tools to make an economy work: monetary policy, and fiscal policy...

Where I use the word "tools" Simon Wren-Lewis says "instruments".

Two tools of policy, I say. Two instruments of policy, he says. But we do agree on what those tools (or instruments) are.

The rest of that thought is all mine:

Government has two tools to make an economy work: monetary policy, and fiscal policy. But our national policy decisions combine these policies badly. Monetary policy has been at odds with fiscal policy since the end of World War II.

The problems in our economy today are a result of our conflicting policies. In order to repair our economy, it will be necessary to make the policies cooperate. If you know how the policies work and how they conflict, then you will know what must be done.

Fiscal policy is often called "tax and spend" policy. We think of it as something that the government wants more of, while we want less. But there is more to it than that. Taxes are used in many ways to encourage economic growth. Tax policy encourages business spending in order to boost economic activity and boost incomes. Fiscal policy is a highly effective way to stimulate the economy.

Fiscal to economic growth.

Monetary policy takes money out of circulation in an attempt to reduce inflation...

Monetary to inflation control.

Takes money out of circulation... Or raises interest rates to reduce the growth of borrowing and reduce the pace at which bank money is being added to the economy. Say it however you want. It still comes down to reducing the growth of the quantity of money. It still comes down to taking money out of circulation.

Monetary policy takes money out of circulation in an attempt to reduce inflation. While our economy has grown over the last half century, the money supply has dwindled from 50 cents to 15 cents per dollar's worth of output. That decrease is the result of the monetary policy actions against inflation. We have created a nation of customers without money.

The quantity of money hung in the neighborhood of 15 cents (per dollar of output)

from the mid-70s to the mid-90s. I could have written those words at any time during those years. (I did.)

Since the mid-90s the quantity of M1 money continued to dwindle, falling below ten cents per dollar of output shortly before the GFC, no doubt contributing to it.

Since 2008 the ratio has been rising. To restore the economy, the central bank reversed the trend. It is now above 16 cents. But it is not enough: We still have too much debt, public and private. We need less debt and more money per dollar of GDP.

Note that increasing the quantity of government money is not inflationary if we compensate by reducing the quantity of money created by private lending. In other words, "less debt" is a way to fight inflation.

Monetary policy can only achieve less debt by raising interest rates, so that new additions to borrowing are reduced. But that means new additions to GDP are also reduced: Raising interest rates is bad for growth.

Why not change the assignments, and use fiscal policy to fight inflation? We can establish variable tax rates that encourage the repayment of debt (so you can reduce your taxes by making extra payments on your debt). This approach gives us "less debt" by reducing existing debt. The central bank can keep interest rates low to encourage borrowing, to encourage economic growth. We can grow the economy and fight inflation at the same time, up to the point of full employment of resources.

Fiscal to inflation control. Monetary to economic growth.

On the one hand, monetary policy takes money out of circulation in order to limit spending. On the other hand, tax policy does everything possible to make our spending grow. As a direct result of these policies, we have less money but our spending has increased anyway. We have made up the difference by increasing our use of credit. And that has produced a tremendous accumulation of debt.

My evaluation of the conventional assignments:

- Fiscal to economic growth

- Monetary to inflation control

My evaluation is essentially the same as that of Simon Wren-Lewis, Martin Sandbu, and JW Mason.

Sandbu offers it as the current state. Wren-Lewis says no-no, that consensus is now dead (though this, it seems to me, is largely wishful thinking). Mason and Jayadev offer it as the orthodox consensus; they compare and contrast it with a heterodox view. I propose a reversal of the assigments, because our policies as they stand undermine each other.